Hi kids. Remember me? I'm the really boring old guy who sleeps with 18-year-old girls solely to hear them tell him how young he looks. I'm really boring and I have to read about financial markets a lot (as opposed to grocery markets which actually are financial markets and hoo boy do I feel a digression coming on; I'll just quit while I'm… I'm stopping now).

Anyway, last week I shared with you some details about quantitative easing, which is neither quantitative nor easing. This week, I would like us to take the time to honor the men and women of the armed forces (who cannot be blamed for the wars they're in) by writing about the global financial equivalent of the Tet Offensive. That's right: it's Currency War time bitches. Put on your boots and dig those trenches. Unless you graduated college, in which case I need that logistics report done before you go off and play golf, Captain.

The powers that be have told us that quantitative easing was an attempt to avoid deflation by purchasing a bunch of securities with borrowed money. Last week, I told you why that explanation was nothing more than bull excrement (see: Core CPI is a big lie). You see, even Ben Bernanke knows that quantitative easing will not be good for the American dollar but he has to tell you otherwise or the Global Villains Union takes away his benefits.

China continues to raise its interest rates and build reserves because they know their best customer won't be around forever, especially if said customer keeps devaluing their currency.However, there is another reason (or excuse) Ben will use for printing a shit ton of money and stealing your purchasing power: he wants to win the Currency War and bring jobs back to America.

Before believing Pimp Daddy B here, I want to remind you that the Federal Reserve only does what is in the best interest of its member bankers. It doesn't care about you. And it sure as hell doesn't care about this alleged Currency War. Make sure you remember that because it's important (not as important as clean water, but close).

Now, you might be asking yourself, "Nathan, what is the Currency War?" And to you I say, not so fast. Before I can get to the definition of a Currency War, we have to understand a little bit about how currencies behave and a little bit about American relations with China. But don't worry, I'll be gentle.

Unless you don't like it gentle.

I get a feeling you don't like it gentle.

Dollar Dicks Backing Worldwide Asses

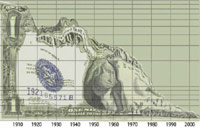

Purchasing power of the U.S. dollar, 1900-2005. Am I doing acid or is the dollar weakening? OR BOTH??Back before banks made theft of purchasing power a law in every country in the world (see: fiat money, federal reserve, Bank of England, etc.), currencies used to represent a specific amount of a precious metal. They stopped all that noise a long time ago because it was way too safe and boring. No one wants a currency to be safe and boring. You want a currency that will pop, that will rise and fall and do all kinds of crazy shit. You want to be able to contract and expand your money supply like a porn star playing with a penis. Fiat money makes life much more entertaining for market traders and analysts because it creates all kinds of awesome drama-filled stuff like rampant poverty and debt-based derivatives.

Anyway, after the precious metal standards were deemed silly and old and kooky and boring, the world ran into a little bit of a problem: it didn't know what to base its currencies on. So, naturally it started buying up each others' debt. The safer a global currency was, the less its global debt paid out (and the stronger the currency was at the time of pay-out).

And nobody's global debt paid as little as the United States' debt. The US dollar was deemed super safe because the country's history of inflation was low and its value against most global currencies was strong. So, a bunch of countries bought our debts and started using our future payouts of dollars for said debts to back their countries' currencies. China was one of those countries.

Now, every time that the United States decides to lower interest rates, or quantitatively ease, or stimulate, or whatever euphemism they use for "print more money," they devalue the currency, which means that when China decides to collect on its treasury debt, they will be paid in a dollar that is much weaker than the dollar they bought into. For example (and please forgive the math) if China buys into a 10-year treasury note with a promise of an annual payout of one percent per year and we devalue our currency to the tune of three percent of year, China just secured their currency with a declining debt instrument (I like to think of debt instruments as trumpets and saxophones for some reason—I bore easy) and therefore, lost money. That probably makes them mad. But I hear they're a tough people to get a bead on anyway so that's just a guess.

Therefore, just by being invested in treasury debt in the last ten years, every country that has used our dollars to back their currencies has lost money on their investments. To this we shrug and say, "Fuck ‘em." I mean, who asked them to rely on us to make their currency worth something? And in most cases, with most countries, this is a fine way to think; but you see China, well China is something a little special.

Friends with Deficits

American flags: the first major ad revenue generator for the US?It is no lie that China makes something near all the stuff we use to live cheaply in the US. In fact, one of the main reasons that we never seem to realize how badly our dollar is being devalued is because, if the good in question is not a foodstuff (I love using that word on dates by the way: "Mmm, this foodstuff is delicious"—really turns on the ladies) or a source of energy (like gasoline), it seems to have actually gotten cheaper.

Televisions, microwaves, plastic products, etc. have all gotten cheaper over the years because they are made in a country that keeps its currency artificially low against our inflating currency. In other words, the stuff China makes seemed to get cheaper for years because, as our currency inflated, theirs actually fell, which meant we were able to buy more of their stuff with the same amount. Because of this, you can buy a desk at Walmart for roughly the price of one porterhouse steak in the grocery store.

(Side note: Walmart prices are really fucking with me, now. It's like, really, I can get a George Foreman Grill for the price of a pack of cigarettes? The fuck is going on in that place?)

A lot of old timers can tell you all about how many times they tried this shit in the 30's. You see, against the ever-inflating dollar, that which cannot be manufactured will always get more expensive, but that which can be manufactured will be manufactured by the country that does the best at keeping its currency value low against the dollar. And so, if you want to export manufacturing, your best bet is to have a low currency value versus other world currencies.

And so, the United States has decided that the best way for it to create manufacturing jobs and increase American exports is to weaken the dollar. And so they quantitatively ease.

Meanwhile, China continues to raise its interest rates and build reserves because they know their best customer won't be around forever, especially if said customer keeps devaluing their currency.

Because Chinese interest rates are growing, because their GDP grows at like ten percent a year, and because America is suffering, the powers that be feel that China should devalue its currency. To that China said, "Fuck you. You do a good enough job of that for us."

And so we quantitatively ease.

Currency War III: The Empire's on Crack

Every year, Christmas shopping moves further into the red.Now, will it work?

Will the United States' attempt to devalue its currency increase its ability to export goods to other countries and create the jobs our citizenry so desperately needs?

Not a fucking chance in hell.

The sad thing about this is, we've done it before. A lot of old timers can tell you all about how many times they tried this shit in the 30's.

(Side note: By far and away, the least entertaining thing to come out of this financial mess we're in is the number of Depression Era historians coming out of the woodwork and just boring the hell out of me—you know these assholes have been waiting for a chance to say things like "Smoot Hawley" and "interventionism" for decades.)

Here's what will happen: we'll lower the value of our currency; they'll lower the value of theirs; we'll lower the value of our currency; they'll lower the value of theirs; other countries will do the same and the bankers will get super rich on all the coin they're minting (they get paid every time we print money); the percentage of the world with the majority of the worlds' wealth will actually shrink; power will be consolidated, citizens will get upset, and then eventually we'll try (forgive me for this, Jesus) interventionism (such a boring word).

We'll put tariffs on goods and services imported from China and China may actually stop sending us manufactured products. (Note: China has already halted export of rare earth metals to the US and Europe in response to UN and US disallowing China to purchase controlling interest in foreign commodities-based companies [like Potash], so in a way, we're already at this stage. In another way, I feel I am really boring the piss out of y'all this week.) It doesn't really matter if China accepts the tariffs or stops sending us goods because either way, the cost of those goods (to us) will increase.

Let me repeat that so it is clear: no matter what trick you use, whether it be printing money or placing tariffs or just hiding wealth, the net result is ALWAYS an increase in the cost of living to the citizenry.

Because you see, in a Currency War, no matter who fights, we lose.

So, to summarize this little chunk of depressing financial gobbledy gook: America is devaluing its currency with the (stated) goal of job creation, which will spark world interest to devalue their currency, which will make global bankers much richer while the global cost of living increases. Essentially, our rulers are gambling with our money, which wouldn't be so bad if our rulers weren't playing the roles of both gambler and bookie.

Oh yeah, and just in case the 1600 words above weren't proof enough, you may need to be informed of the factoid that I am, in addition to being a world class harmonica player, a really boring old dude.